What is a marketplace? Find out how to get the most out of it

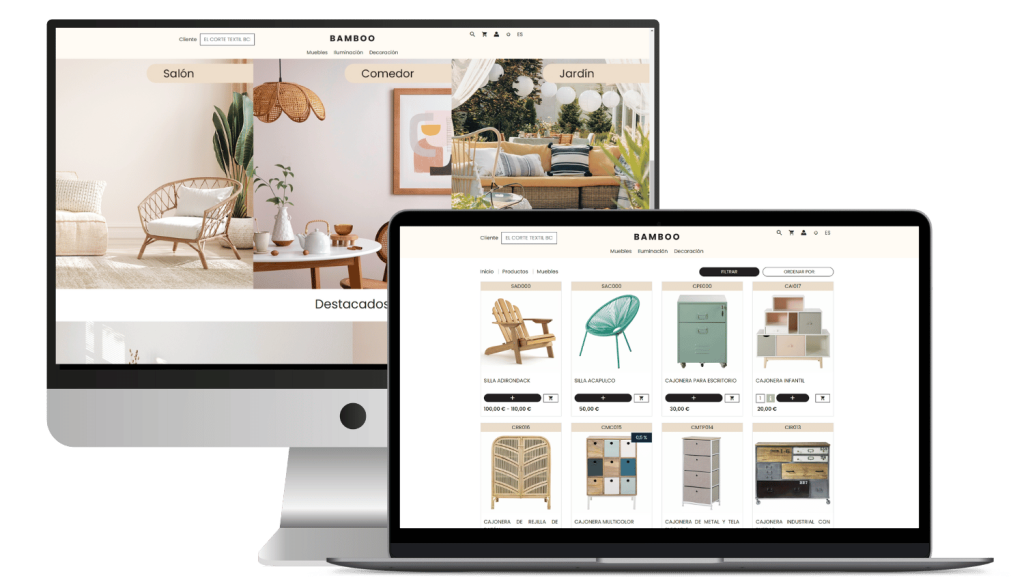

What is a marketplace? Find out how to get the most out of it In today’s digital world, marketplaces have

In the world of finance, sound decision making is the fundamental pillar on which the success of any company is based.

Among the wide range of tools available to assess the viability of an investment, the payback, also known as the amortization period, has positioned itself as a key indicator due to its simplicity and practicality.

Throughout this article, we will not only delve into the concept of payback, but we will also guide you step-by-step in its calculation so that you can apply it accurately to your own financial projects.

Payback, in essence, allows us to determine the time it takes a company to recover the initial investment made in a specific project or asset. In other words, it tells us how long it takes to generate net cash flows equal to the amount invested at the beginning.

Its calculation is based on the division of the initial investment by the annual net cash flows generated by the project. This crucial information is obtained from the company’s financial statements, specifically the cash flow statement.

Payback has become a fundamental tool for financial decision making for a variety of reasons:

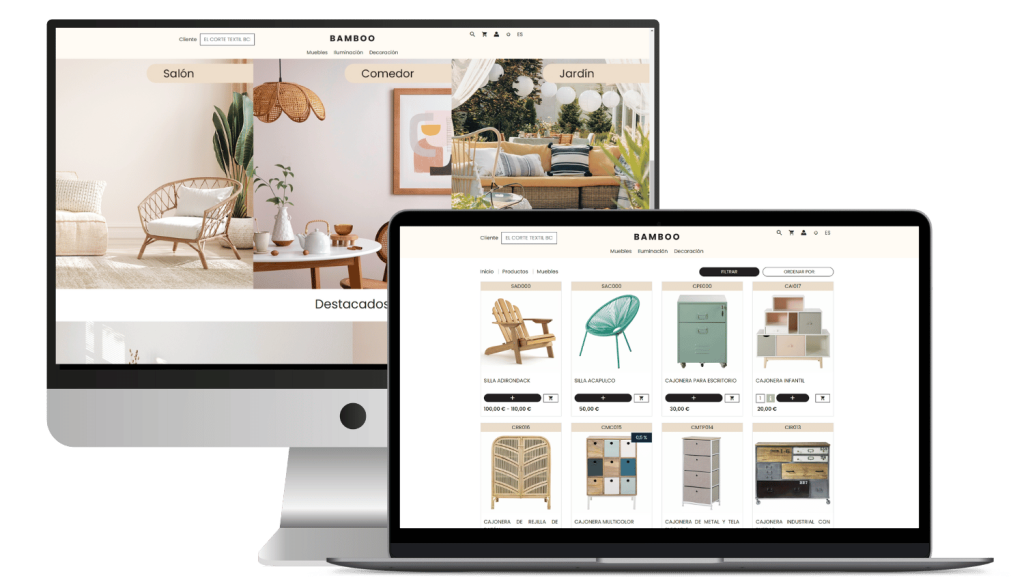

Integrate your ERP with B2B ecommerce with Stoam SaaS

To calculate the payback of an investment, it is necessary to follow these steps:

The basic formula for calculating payback is as follows:

Payback = Initial investment / Net cash flows per year

Assume the following situation:

We want to calculate in how many years the initial investment will be recovered.

Step by step:

The initial investment of €10,000 is recovered somewhere between the end of Year 3 and the beginning of Year 4. To be more precise, we calculate the fraction of Year 4 needed to recover the remaining €1,000:

Result:

The payback period is 3 years and an additional 0.2 years, or 3 years and 2.4 months.

The payback result is expressed in years. A low payback indicates that the investment is recovered quickly, which makes it more attractive. Conversely, a high payback means that it takes longer to recover the investment, which may imply a higher risk.

While payback is a useful tool for the initial evaluation of investments, it is important to consider its limitations:

Transform your ERP into a powerful B2B ecommerce system

Payback is a useful tool for the initial evaluation of investments, but it is important to consider its limitations and complement it with other financial indicators for a more complete decision making process.

At Stoamwe offer a SaaS software software that allows you to calculate the return on your investments quickly and easily, in addition to providing you with other relevant financial indicators and benefits. relevant benefits for the correct operation of your projects.

¡Contact us today today and find out how we can help you!

Share:

What is a marketplace? Find out how to get the most out of it In today’s digital world, marketplaces have

Business to consumer (B2C): how it works and how it differs from B2B In today’s world, e-commerce and direct business-to-consumer

Alibaba revolutionises B2B commerce with ‘Accio’ – the AI-powered search engine for SMEs Share: Tabla de contenidos What is Accio

Examples of market segmentation: How to apply it in different sectors? In today’s competitive business landscape, market segmentation is more

Omni-channel strategy: How to integrate all channels to improve customer experience In a world where consumers use multiple channels to

What are open APIs and their role in SaaS solutions? Open APIs have transformed the way businesses use software, especially

Analysis of B2B marketplaces: Are they an opportunity or a threat? B2B marketplaces are transforming the way companies buy and

How to use chatbots in B2B ecommerce to improve conversions In the world of ecommerce B2B (Business to Business)shopper expectations

ERP and sustainability: How a system can reduce environmental impact Sustainability has become a crucial priority in today’s business landscape.

Automate orders with Stoam SaaS b2b ecommerce