How to manage your company's cash flow? Complete guide to maintain liquidity

What is cash flow and why is it essential for your business?

Definition of cash flow

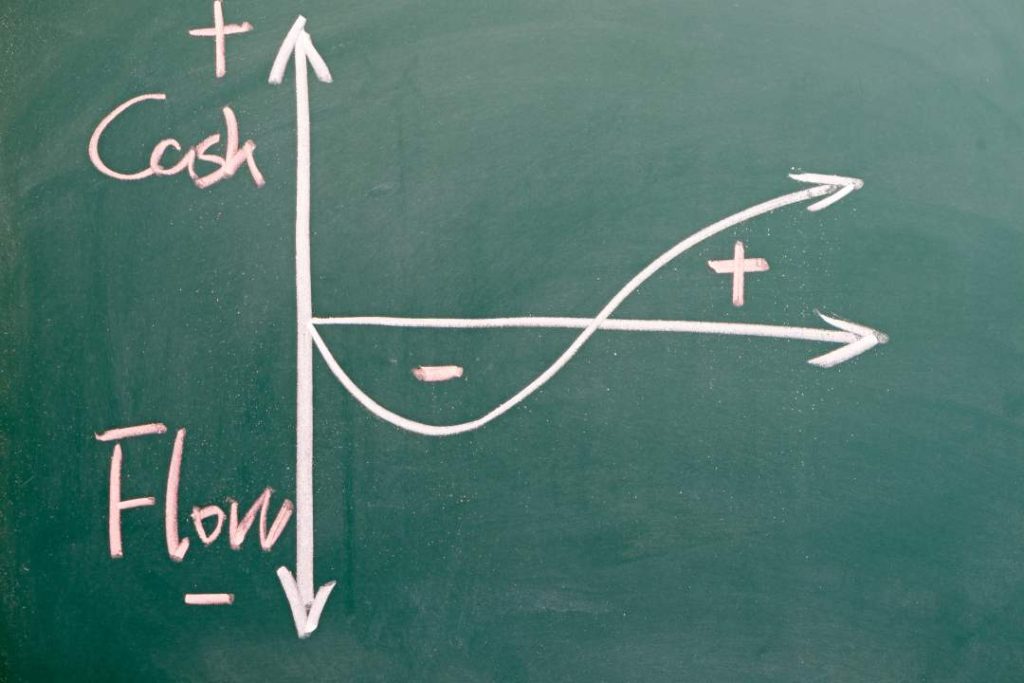

The Cash flow is a term that refers to the net amount of cash flowing in and out of a company during a specific period. This concept includes all cash inflows and outflows, providing a clear view of financial health in terms of liquidity. Cash inflows can come from sales, investments, or financing, while outflows include payments to suppliers, salaries, taxes, and other operating expenses. A positive cash flow indicates that a company has enough cash to cover its obligations and make investments, while a negative cash flow may signal impending financial problems.

- What is cash flow and why is it essential for your business?

- Types of cash flow: Everything you need to know

- How to calculate cash flow accurately

- Effective strategies for managing your company's cash flow

- Importance of cash flow in business sustainability and growth

- Cash flow management tools and resources

- Conclusion: Ensure your company's financial stability with effective cash flow management

- Frequently asked questions about cash flow management

Differences between cash flow and cash flow

It is important to distinguish between cash flow y cash flowalthough these terms are often used interchangeably. Cash flow focuses specifically on the movement of cash and its availability in the short term, while cash flow is a broader concept that encompasses not only cash inflows and outflows, but also changes in other assets and liabilities, such as accounts receivable, accounts payable and depreciation. Cash flow includes elements that affect liquidity indirectly, such as the impact of investment and financing decisions.

Why is cash flow crucial in financial management?

The cash flow is crucial for financial financial management because it provides immediate insight into a company’s ability to meet its daily obligations and maintain ongoing operations. Without proper control of cash flow, a company can face liquidity problems that could lead to the inability to pay suppliers, employees, or meet other financial responsibilities. In addition, good cash flow allows companies to take advantage of investment and expansion opportunities, as well as serve as a reserve in times of economic uncertainty.

Types of cash flow: Everything you need to know

Operating cash flow

The Operating cash flow is cash generated or used in the day-to-day operations of the business. This includes revenue from sales of goods or services and payments made for operating expenses such as salaries, rent and supplies. A positive operating cash flow indicates that the company is generating enough cash from its core activities to cover its costs and potentially reinvest in the business.

Investment cash flow

The investment cash flow reflects cash used or received from activities related to the acquisition or sale of long-term assets, such as property, machinery, or investments in other businesses. Capital expenditures to acquire new equipment or property are usually a cash outflow, while the sale of assets may generate cash inflows. Analyzing this type of cash flow is essential to evaluate how investment decisions affect the company’s liquidity and ability to grow.

Financial cash flow

The financial cash flow refers to transactions related to the financing of the company, such as borrowing, issuing stock or paying dividends. This type of cash flow shows how the company is managing its capital structure and its obligations to investors and lenders. A positive financial cash flow may indicate that the company is receiving external financing or repaying debts, while a negative financial cash flow may indicate that the company is repaying loans or paying dividends.

How to interpret each type of cash flow in your business

Interpreting the different types of cash flow is crucial for a complete understanding of the company’s financial situation. A positive operating cash flow indicates that core operations are healthy and generating cash, which is critical for short-term stability. A negative investing cash flow can be a sign that the company is investing in its future growth, which is generally positive if the investments are strategic and well-planned. Finally, a positive financial cash flow can signal an effective capital raising strategy, but it is important to ensure that you are not relying excessively on external financing to operate.

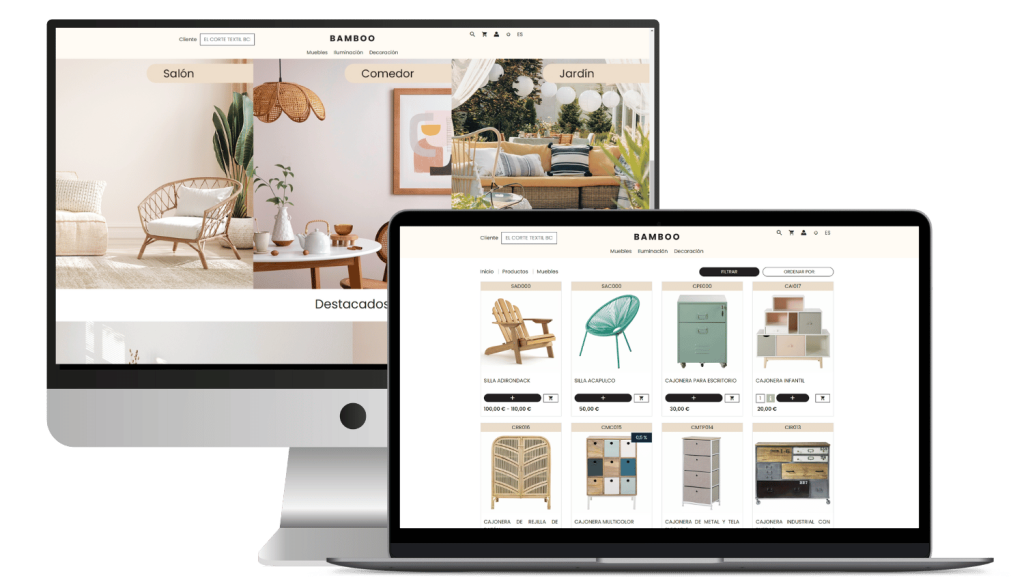

Integrate your ERP with B2B ecommerce with Stoam SaaS

How to calculate cash flow accurately

Key data required for cash flow calculation

To calculate cash flow In order to ensure accurate reporting, it is essential to collect key data such as operating income and expenses, investment transactions, and financing activities. Necessary data includes:

- Sales revenue: All revenue generated from sales of products or services.

- Operating expenses: All payments made to cover day-to-day operating costs, such as salaries, rent and supplies.

- Investments: Expenditures on long-term assets and asset sales.

- Financing activities: Loans received, loan repayments and dividends paid.

A detailed and accurate record of these elements is essential to obtain a clear and accurate view of cash flow.

Cash Flow Formula: Step by Step

The basic formula for calculating cash flow is:

Cash flow=Cash inflows-Cash outflows

In order to calculate operating cash flow, the net income must be adjusted for net income by adding or subtracting non-cash items, such as depreciation, and modifying working capital. The formula can be broken down into:

- Net income: Total revenues minus total expenses.

- Non-cash adjustments: Add depreciation and amortization.

- Changes in working capital: Adjust for changes in accounts receivable, accounts payable and inventories.

Common mistakes when calculating cash flow and how to avoid them

When calculating cash flow, it is common to make mistakes such as:

- Omission of significant items: Be sure to include all cash inflows and outflows, and do not omit significant transactions.

- Incorrect classification of transactions: It is crucial to correctly classify transactions as operating, investment or financial.

- Failure to update data: Keep data up to date and review calculations regularly to avoid errors.

To avoid these problems, perform periodic audits of your calculations and verify the accuracy of your financial records. Use accounting and financial management tools to automate and ensure the accuracy of calculations.

Effective strategies for managing your company’s cash flow

Best practices for maintaining positive cash flow

Maintain a positive cash flow is critical to the financial stability of the company. Here are some best practices:

- Planning and forecasting: Perform cash flow projections to anticipate future cash needs and plan accordingly.

- Accounts receivable and payable controlImplements strict policies for accounts receivable management, including regular monitoring of payments and effective collection. Negotiates favorable payment terms with suppliers to balance cash outflows.

- Maintaining cash reserves: Maintain an adequate cash reserve to cover contingencies and financial emergencies.

How to optimize inventory management to improve cash flow

Optimize inventory management is crucial to freeing up cash and improving cash flow. Some strategies include:

- Implementation of just-in-time systemsMinimizes inventory levels to reduce tied-up capital and warehousing costs.

- Inventory turnover analysis: Track inventory turnover to identify and reduce overstock and obsolescence risk.

- Order optimization: Adjusts order levels and replenishment times to align with actual demand and reduce the risk of excess inventory.

Negotiation with suppliers to alleviate financial pressure

The Negotiation with suppliers is a key strategy for relieving financial pressure. You can:

- Extend payment terms: Negotiate longer payment terms to allow more time to generate cash before making payments.

- Ask for early payment discounts: Take advantage of early payment discounts to reduce costs and improve cash flow.

- Establish staggered payment arrangements: Divide payments into installments to spread the financial burden over time.

Improving customer collection policies: Keys to accelerate the cash cycle

To improve cash flow, it is essential to accelerate the customer collection cycle by:

- Implementation of efficient billing systems: Utilizes automated systems to generate and send invoices in a timely manner.

- Offering incentives for early paymentOffer discounts or benefits to encourage customers to pay before the due date.

- Perform regular follow-ups on accounts receivable.Establish follow-up procedures for outstanding accounts and perform regular reminders.

Cost control and its impact on cash flow

The Cost control is critical to maintaining a healthy cash flow. Some effective actions include:

- Periodic expense review: Regularly evaluate operating expenses and look for areas where you can reduce costs without affecting quality or efficiency.

- Contract renegotiation: Reviews and renegotiates contracts with suppliers and lenders to obtain better terms and conditions.

- Pursuit of operational efficienciesImplement more efficient processes and technologies that can reduce operating costs and free up cash.

Transform your ERP into a powerful B2B ecommerce system

Importance of cash flow in business sustainability and growth

Impact of cash flow on the company’s liquidity and solvency.

Robust cash flow has a significant impact on liquidity. liquidity and solvency of the company. Proper cash flow management ensures that the company has sufficient cash to meet its immediate obligations and avoid insolvency problems. The ability to maintain a positive cash flow enables the company to meet financial challenges and operate with stability, even in times of economic uncertainty.

How cash flow influences investment capacity

A healthy cash flow also directly influences the company’s ability to make investments. investments.

La disponibilidad de efectivo permite a la empresa financiar proyectos de expansión, adquirir nuevos activos, o invertir en innovación.

Un flujo de caja positivo proporciona la flexibilidad financiera necesaria para aprovechar oportunidades de crecimiento y mejorar la competitividad.

Sustainable cash-flow based growth strategies

Business growth must be supported by sound cash flow management. Strategies for sustainable growth include:

- Strategic financial planningUse cash flow projections to plan for long-term growth and ensure that it is backed by adequate financial resources.

- Reinvestment of earnings: Invest internally generated earnings to finance growth and reduce dependence on external financing.

- Income diversificationBroadens revenue sources to reduce dependence on a single cash flow and improve financial stability.

Cash flow management tools and resources

Financial management software that optimizes cash flow

The Financial management software can be a valuable tool for optimizing cash flow. These programs offer advanced functionality for tracking transactions, forecasting cash flow, and generating detailed reports. Some key features to look for in software include:

- Process automation: Facilitates the automation of accounting and cash flow management to reduce errors and improve efficiency.

- Integration with other systems: Allows integration with billing systems, banks and other financial platforms for a more complete view of finances.

- Reporting and analysis: Provides analysis and reporting tools to effectively monitor and evaluate cash flow.

Templates and models for effective cash flow monitoring

Use templates and models for cash flow tracking can simplify the process and improve accuracy. Some useful templates include:

- Cash flow forecast templates: Help forecast cash inflows and outflows to plan ahead.

- Cash flow analysis models: Facilitate the evaluation of different scenarios and their impact on liquidity.

- Accounts Receivable and Payable Tracking Tools: Enable effective monitoring of accounts and help maintain a balanced cash flow.

Conclusion: Ensure your company’s financial stability with effective cash flow management

A Effective cash flow management is critical to ensuring the financial stability and long-term success of your business. Implementing best practices, using specialized tools and maintaining a proactive approach to cash flow management can help you maintain adequate liquidity, meet financial challenges and take advantage of growth opportunities. The key is to always be aware of variations in cash flow and take appropriate measures to maintain financial stability.

Frequently asked questions about cash flow management

The best way to calculate cash flow is to use an accurate formula and make sure that all relevant data is included. The basic formula is:

Cash flow=Cash inflows-Cash outflows

For a more detailed calculation, you should break down the inflows and outflows into operating, investment and financial flows, and adjust the data as necessary.

If your cash flow is negative, consider the following actions:

- Review and adjust expensesIdentify areas where you can reduce costs and improve efficiency.

- Negotiate with suppliers: Extend payment terms or request early payment discounts.

- Optimize accounts receivable: Implement more effective collection policies and track outstanding accounts.

Cash flow can help you anticipate financial problems by providing a clear picture of trends in cash availability. By analyzing cash flow projections and monitoring them regularly, you can identify patterns that could indicate future problems. This information allows you to take proactive steps to adjust your operations, better manage working capital and avoid financial difficulties before they arise.

Share:

Related Articles

What is a marketplace? Find out how to get the most out of it

What is a marketplace? Find out how to get the most out of it In today’s digital world, marketplaces have

Business to consumer (B2C): how it works and how it differs from B2B

Business to consumer (B2C): how it works and how it differs from B2B In today’s world, e-commerce and direct business-to-consumer

Alibaba revolutionises B2B commerce with ‘Accio’ – the AI-powered search engine for SMEs

Alibaba revolutionises B2B commerce with ‘Accio’ – the AI-powered search engine for SMEs Share: Tabla de contenidos What is Accio

Examples of market segmentation: How to apply it in different sectors?

Examples of market segmentation: How to apply it in different sectors? In today’s competitive business landscape, market segmentation is more

Omni-channel strategy: How to integrate all channels to improve customer experience

Omni-channel strategy: How to integrate all channels to improve customer experience In a world where consumers use multiple channels to

What are open APIs and their role in SaaS solutions?

What are open APIs and their role in SaaS solutions? Open APIs have transformed the way businesses use software, especially

Analysis of B2B marketplaces: Are they an opportunity or a threat?

Analysis of B2B marketplaces: Are they an opportunity or a threat? B2B marketplaces are transforming the way companies buy and

How to use chatbots in B2B ecommerce to improve conversions

How to use chatbots in B2B ecommerce to improve conversions In the world of ecommerce B2B (Business to Business)shopper expectations

ERP and sustainability: How a system can reduce environmental impact

ERP and sustainability: How a system can reduce environmental impact Sustainability has become a crucial priority in today’s business landscape.

Automate orders with Stoam SaaS b2b ecommerce