What is a marketplace? Find out how to get the most out of it

What is a marketplace? Find out how to get the most out of it In today’s digital world, marketplaces have

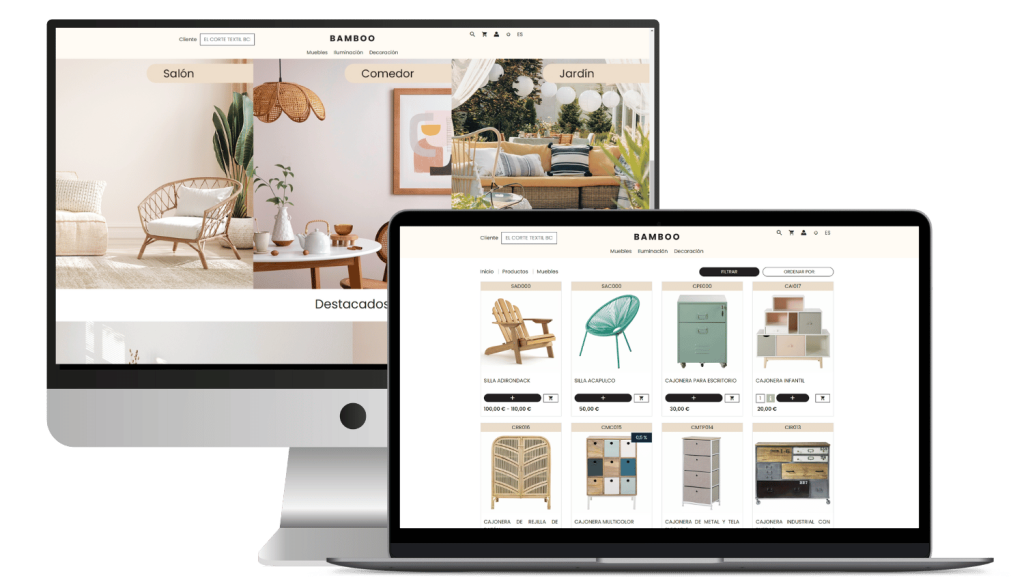

The electronic invoicing is a system that allows the issuance, receipt, storage and management of invoices in digital format. Instead of using paper documents, invoices are sent and received through secure electronic platforms, following specific regulations. Key features include process automation The integration with other accounting systems and the ability to generate detailed and accurate reports. Electronic invoicing eliminates the need for manual document handling, which reduces errors and improves operational efficiency.

The main advantages The benefits of electronic invoicing are numerous. First of all, it improves efficiency and agility in invoice management, enabling faster issuance and receipt. It also reduces the risk of errors by automating many of the manual tasks. Another significant advantage is the cost reduction associated with paper, printing and storage of physical invoices. Electronic invoicing also facilitates compliance with tax regulationsThis allows for easier and more accurate auditing and tracking.

In practice, electronic invoicing electronic invoicing is used in a variety of sectors. For example, many empresas multinacionales use electronic invoicing platforms to handle large volumes of international transactions efficiently. In the field of public administrationIn addition, numerous governments have implemented electronic invoicing systems to optimize tax management and reduce fraud. In addition, in commerce e-commercee-invoicing facilitates fast payment processing and accurate financial reporting.

The traditional billing involves the issuance of paper invoices, which are either mailed or physically delivered to customers. The process generally includes the manual creation of invoices, printing on paper, and mailing or delivery. Next, you must keep a physical record of invoices issued and received. This method requires a physical storage of documents and a manual manual management data management, which can be laborious and error-prone.

The Paper invoicing has a number of associated costs. These include printing costsprinting postage and physical storage of invoices. These costs can add up significantly, especially for companies that handle a high volume of transactions. In addition, the manual invoice of invoices may require more time and resources, which increases operating costs compared to electronic systems.

The traditional billing presents several risks and disadvantages. Among the most prominent is the risk of loss or damage of physical documents, which may affect the ability to adequately track transactions. There is also a risk of manual errors in the issuance and processing of invoices. Paper invoicing is less efficient and agileThe manual processes can slow down the workflow and increase processing time. In addition, this method can be less secure compared to electronic systems, which offer advanced data protection measures.

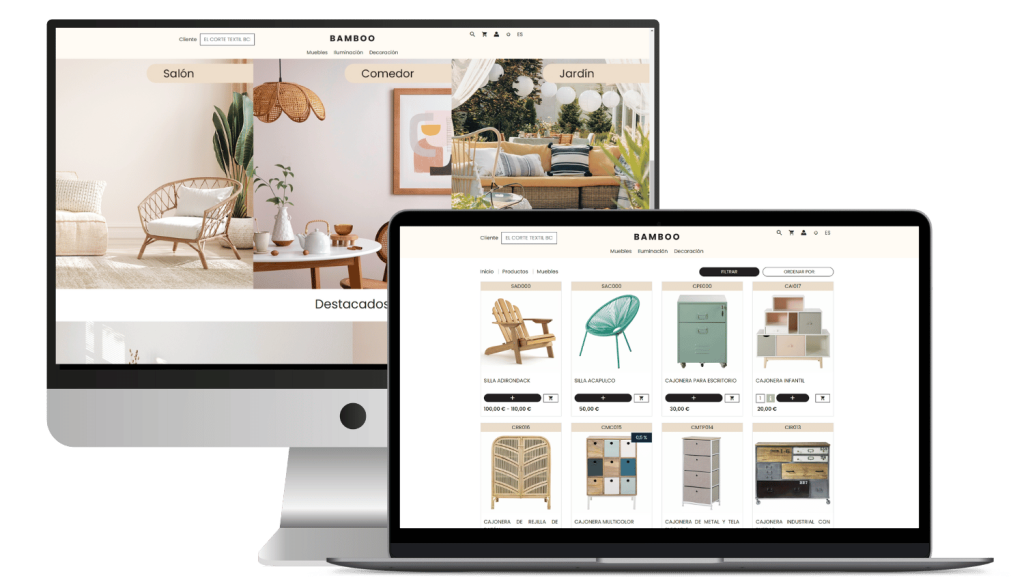

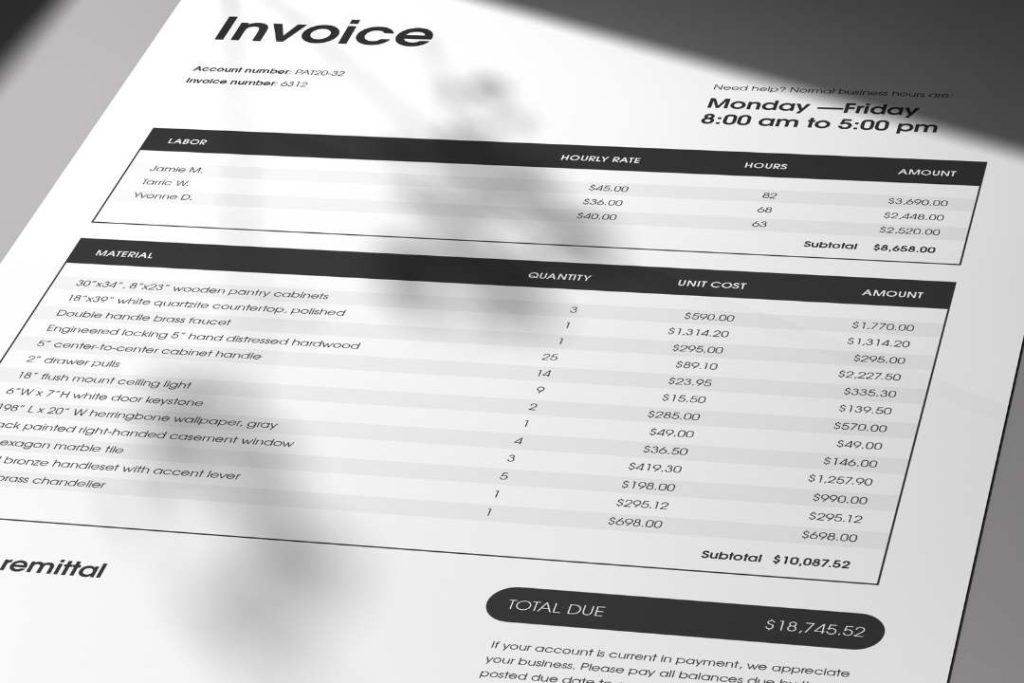

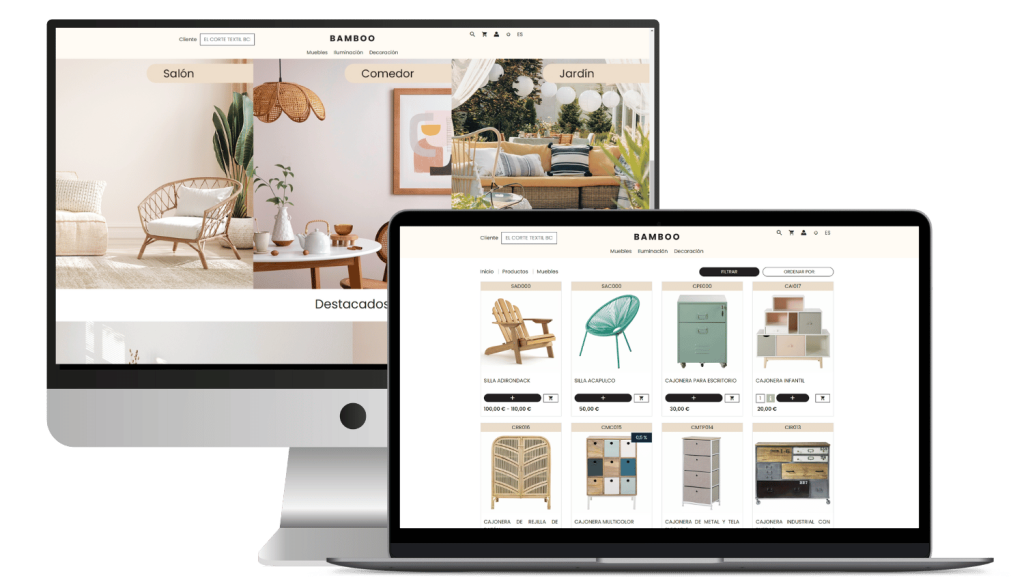

Integrate your ERP with B2B ecommerce with Stoam SaaS

In terms of cost and efficiencyin terms of cost and electronic invoicing generally outperforms traditional invoicing. Electronic invoicing eliminates expenses such as paper, ink y mailingsignificantly reducing operating costs. In addition, the automation of processes in electronic systems reduces the time required for issuing and receiving invoices, improving efficiency efficiency.

Por otro lado, la facturación tradicional incurre en costos recurrentes asociados con el manejo físico de documentos, lo cual puede resultar más caro y menos eficiente a largo plazo.

In terms of security and confidentialitythe electronic invoicing offers several advantages. Modern electronic invoicing systems use advanced security protocols to protect data, such as encryption and controlled access. This reduces the risk of fraud y data loss.

La facturación tradicional, al depender de documentos físicos, enfrenta mayores riesgos de theft o damage of information. In addition, the physical security of storage facilities is crucial, which can be an additional challenge.

The environmental impact is another important consideration. The electronic invoicing has a reduced environmental impact, since it eliminates the need for paper and reduces the consumption of natural resources. In addition, it reduces the generation of waste y carbon emissions associated with postal transport. In contrast, traditional billing contributes to deforestation and waste accumulation, increasing the company’s ecological footprint.

The adaptability y scalability are key aspects for companies of different sizes. The electronic invoicing is highly scalable and adapts well to large companies companies that handle a large volume of transactions, as well as to small small businesses looking to automate their processes. In contrast, traditional invoicing can be less flexible, especially for growing companies that need to efficiently manage an increase in invoice volume.

Transform your ERP into a powerful B2B ecommerce system

The current legislation varies by country, but in general, there is a move towards greater regulation and standardization. regulation and standardization.

En muchos lugares, la facturación electrónica es obligatoria para ciertos tipos de empresas o transacciones.

Las regulations generally set requirements for the emission, storage emission, storage y transmission of electronic invoicesThe company’s own local regulations are essential to ensure their validity and authenticity. It is essential that companies keep abreast of local regulations to ensure legal compliance.

At Spainthe electronic invoicing is in the process of becoming mandatory for all taxpayers. Under current legislation, it is expected that the electronic invoicing will be mandatory for all companies in the near future, with specific deadlines for its implementation. This measure seeks to improve the fiscal transparency and administrative efficiency.

Es importante que las empresas se preparen para cumplir con estos requisitos legales y evitar posibles sanciones.

To prepare your business for the transition to electronic invoicing, consider the following steps:

For implement electronic invoicingyou will need certain technical requirements y specialized software.

Esto incluye:

The migration from traditional billing a electronic involves several key steps:

To maximize the benefits of electronic invoicing, consider these tips:

In the digital eraelectronic invoicing is becoming the preferred choice preferred option for most companies because of its benefits in terms of efficiency, costs, cost and efficiency, cost y security.

Sin embargo, la decisión de adoptar la facturación electrónica debe considerar las specific needs of each company. Companies that handle a low volume of transactions or operate in regions with technological limitations may find traditional invoicing more suitable in the short term.

The future of billing is clearly oriented towards digitization and automation.

Las tendencias emergentes incluyen el uso de tecnologías avanzadas como la artificial intelligence and the blockchain to improve transparencytransparency efficiency and security of billing processes. Continuing regulatory developments and the adoption of new technologies will continue to shape the billing landscape, providing opportunities for companies to further optimize their financial operations.

Share:

What is a marketplace? Find out how to get the most out of it In today’s digital world, marketplaces have

Business to consumer (B2C): how it works and how it differs from B2B In today’s world, e-commerce and direct business-to-consumer

Alibaba revolutionises B2B commerce with ‘Accio’ – the AI-powered search engine for SMEs Share: Tabla de contenidos What is Accio

Examples of market segmentation: How to apply it in different sectors? In today’s competitive business landscape, market segmentation is more

Omni-channel strategy: How to integrate all channels to improve customer experience In a world where consumers use multiple channels to

What are open APIs and their role in SaaS solutions? Open APIs have transformed the way businesses use software, especially

Analysis of B2B marketplaces: Are they an opportunity or a threat? B2B marketplaces are transforming the way companies buy and

How to use chatbots in B2B ecommerce to improve conversions In the world of ecommerce B2B (Business to Business)shopper expectations

ERP and sustainability: How a system can reduce environmental impact Sustainability has become a crucial priority in today’s business landscape.

Automate orders with Stoam SaaS b2b ecommerce