What are the types of market segmentations?

What is an Electronic Invoice and Why is it Important?

Definition and Main Characteristics

The electronic invoicing is a fiscal document in digital format that replaces the traditional paper invoice. According to Spanish regulations, the electronic invoice has the same legal validity as the physical invoice, as long as it complies with certain technical and legal requirements. An electronic invoice must guarantee the integrity of its contents, authenticity of origin and legibility throughout its life cycle. This is achieved through the use of electronic signatures y digital certificates that ensure that the invoice has not been altered and that the issuer is who he claims to be.

The main features of an electronic invoice include:

- Structured Format: Issued in standardized formats such as InvoiceE, UBL (Universal Business Language) or EDIFACT (Electronic Data Interchange for Administration, Commerce and Transport), each suitable for different types of transactions and requirements.

- Automation and Digitalization: Allows the automation of the issuance and reception process, reducing the time required for processing and improving operational efficiency.

- Regulatory Compliance: You must comply with the regulations established by the Tax Agency and other tax authorities, ensuring that the document is acceptable for legal and tax purposes.

Advantages of Using Electronic Invoices

Cost and Time Reduction

The electronic invoices offer significant benefits in terms of costs y time.

La eliminación del papel y los procesos físicos asociados con la facturación tradicional resulta en:

- Cost ReductionBy eliminating the need for paper, ink, printing and mailing, companies can significantly reduce their operating expenses. The cost associated with the physical storage of invoices is also eliminated, as electronic invoices are securely stored on digital servers.

- Time Savings: Invoice automation reduces the time required to create, send and process invoices. This allows employees to focus on more strategic tasks instead of manually managing physical documents. Quick issuance and receipt of invoices accelerates the cash cycle, improving cash flow.

Legal Compliance and Security

The electronic invoicing not only streamlines processes, but also provides a robust framework for legal compliance. legal compliance y security.

Los beneficios en este ámbito incluyen:

- Legal Compliance: In Spain, electronic invoicing is regulated by several laws and regulations, such as the General Tax Law and the Invoicing Law. Using electronic invoices ensures that all tax and legal obligations are met, avoiding possible penalties for non-compliance.

- SecurityElectronic invoices are protected by digital certificates y electronic signatures that ensure that the data has not been altered and that the identity of the sender is authentic. Data encryption and secure platforms for sending and storage help protect sensitive information from unauthorized access and fraud.

Steps to Create and Send an Electronic Invoice

Prerequisites for Issuing Electronic Invoices

Before issuing electronic invoices, it is necessary to meet certain prerequisites that ensure that the process is carried out in a legal and efficient manner. These requirements include:

Digital Certificate and Required Software

- Digital CertificateAn electronic file provided by a certification authority that acts as an electronic signature. electronic signature.

El certificado digital autentica la identidad del emisor y garantiza que la factura electrónica es válida.

Debe estar vigente y ser emitido por una entidad reconocida, como la Fábrica Nacional de Moneda y Timbre (FNMT) en España. - Invoicing Software: To issue electronic invoices, you need compatible software that allows the creation, issuance and storage of invoices in the required formats. The software must be up-to-date to comply with the latest standards and regulations. Examples of specialized software include Cegid Yet, Sage y FacturaDirecta.

How to Generate an Electronic Invoice

Selection of the Appropriate Format (InvoiceE, UBL, EDIFACT)

The format selection The most commonly used formats for electronic invoicing are: (1) the most common format for electronic invoices; (2) the most common format for electronic invoices; and (3) the most common format for electronic invoices. The most commonly used formats are:

- InvoiceE: Electronic invoices: This is the standardized format in Spain for electronic invoices addressed to public entities. This format complies with the specifications of the electronic invoicing system of the Public Administration.

- UBL (Universal Business Language): It is an international standard used for business-to-business invoicing. UBL is flexible and can be adapted to different types of business transactions.

- EDIFACT (Electronic Data Interchange for Administration, Commerce and Transport)EDIFACT is another international standard used in electronic data interchange. EDIFACT is widely used in sectors that require a high level of standardization in commercial transactions.

Basic Data Entry

To generate an electronic electronic invoice invoice, it is necessary to correctly enter the basic data basic data in the billing software. This data includes:

- Issuer’s information: Name or corporate name, tax ID number, fiscal address and contact information.

- Recipient’s information: Name or company name, tax ID number, fiscal address and contact information.

- Invoice DetailsInvoice details: Invoice number, date of issue, description of goods or services, quantity, unit prices, applicable taxes (such as VAT) and the total amount payable.

- Terms of PaymentInformation on payment conditions, terms and acceptable methods.

Sending and Receiving the Electronic Invoice

Valid Shipping Methods

Once generated, the electronic invoice electronic invoice must be sent and received using valid and secure methods. Methods include:

- Certified Platforms: Many companies use platforms certified by the tax authorities for issuing and receiving electronic invoices. These platforms ensure that invoices are processed in accordance with regulations and provide acknowledgements of receipt.

- Secure E-mail: Another option is to send electronic invoices through secure e-mails, using encryption systems to protect the information during transit.

Tracking and Confirmation of Receipt

After sending an electronic invoice, it is important to follow up on the follow-up to confirm that it has been received and accepted. Follow-up steps include:

- Confirmation of Receipt: Verifies that the receiver has received the invoice through acknowledgements or notifications provided by the billing software.

- Error Management: If problems arise, such as invoice rejections or errors, contact the receiver to resolve any issues and reissue the invoice if necessary.

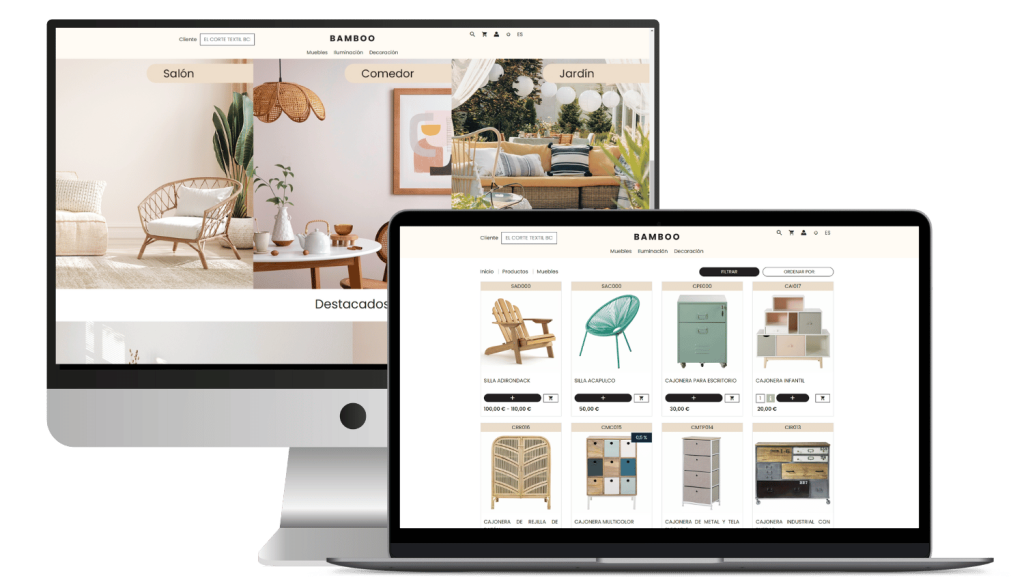

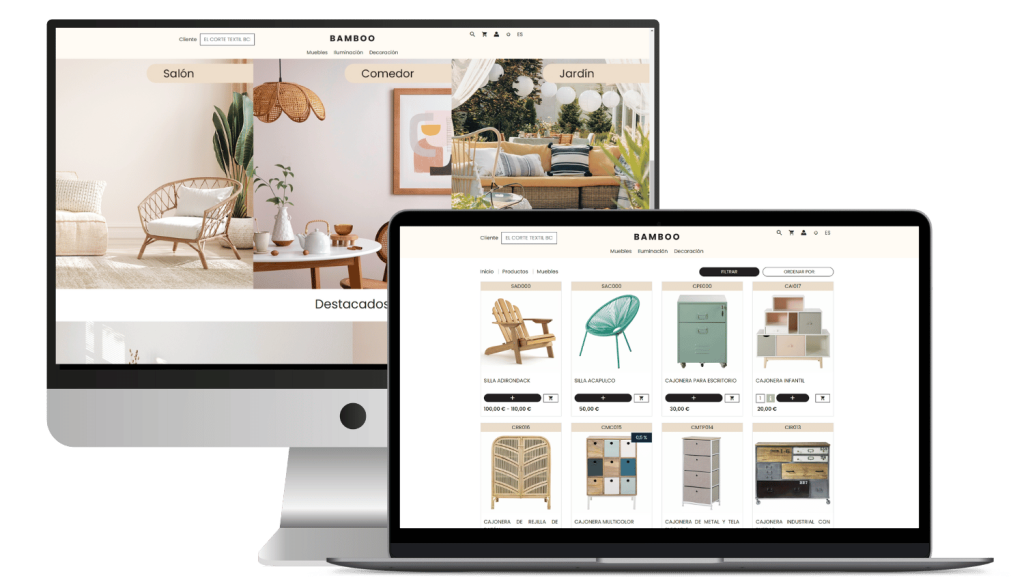

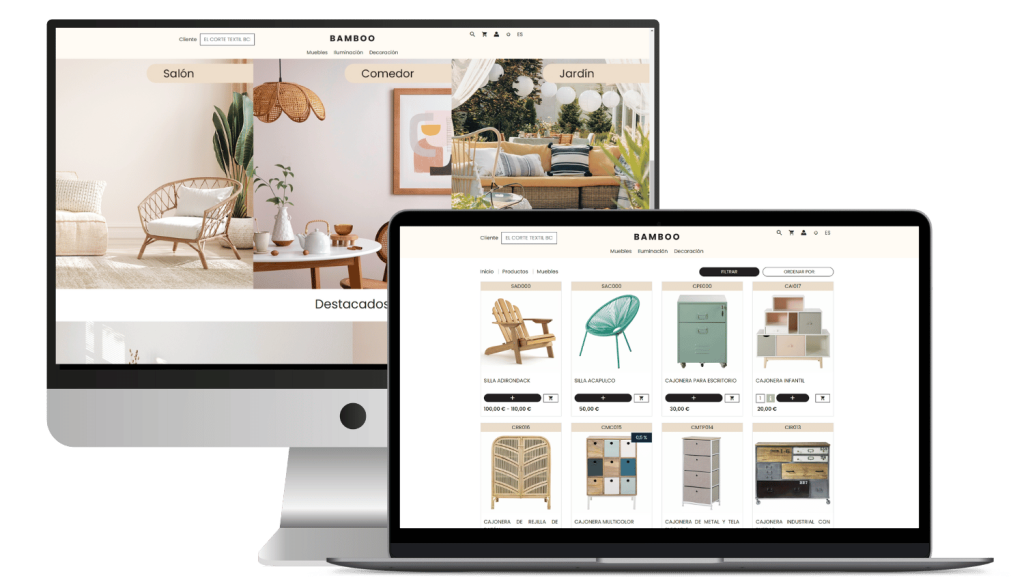

Transform your ERP into a powerful B2B ecommerce system

Regulatory Compliance and Adaptation to the Law

Crea y Crece Law and its Impact on Invoicing

The Crea y Crece Law is a key regulation in the field of electronic electronic invoicing in Spain. This law establishes new requirements and deadlines for the adoption of electronic invoicing, with the aim of modernizing and simplifying administrative and tax processes. Among the main aspects of the law are:

- Obligation to Issue Electronic InvoicesThe law establishes the obligation to issue electronic invoices for certain transactions and types of companies, with the purpose of improving the transparency y efficiency and efficiency in tax management.

- Implementation of Electronic Invoicing SystemsCompanies must adopt systems that allow the issuance, reception and storage of electronic invoices in accordance with the requirements established by law.

Adaptation of Companies to Legislative Changes

Key Dates and Compliance Deadlines

To comply with the Crea y Crece Lawcompanies must be attentive to the deadlines established for the implementation of electronic invoicing. These deadlines may vary depending on the size of the company and the type of transactions performed. It is essential that companies:

- Plan for ImplementationEstablish a plan for adopting electronic invoicing, including software selection, staff training, and internal process adjustments.

- Comply with the Requirements: Make sure to comply with all legal and technical requirements established by law to avoid penalties and problems with the tax administration.

Benefits of Digitalization for SMEs

The digitization of invoicing brings numerous benefits for small and medium-sized enterprises (SMEs), including:

- Operational Efficiency: Invoicing automation reduces the time required to manage documents, allowing SMEs to operate more efficiently.

- Cost Reduction: The elimination of expenses associated with paper and postage contributes to a significant reduction in operating costs.

- Improved Tax ComplianceElectronic invoicing facilitates tax compliance and reduces the risk of errors and penalties.

Technological Solutions for Electronic Invoicing

Main Software for Electronic Invoicing

The market offers various technological technological solutions solutions for electronic invoicingeach with its own characteristics and advantages. Among the main options are:

- Cegid YetThis software stands out for its flexibility and adaptability to different sectors. It offers advanced functionalities for invoice for invoice management, including automation process automation and regulatory compliance.

Es ideal para empresas que buscan una solución integral que se integre con otros sistemas de gestión. - SageSage is known for its robust platform that combines electronic invoicing with other accounting and business management functions. Its intuitive interface y extensive functionality make it a popular choice among companies of all sizes.

- QuadernoQuaderno offers integration with multiple e-commerce platforms and an ease of use outstanding. Its focus on simplicity and automation facilitates billing management for companies operating online.

Comparison of Other Available Programs

When comparing different electronic invoicing programs, it is essential to consider aspects such as:

- FunctionalitiesEvaluates which features each software offers, such as automation automation, integration with other systems and support for different billing formats. billing formats.

- Costs: Compares subscription or licensing costs and possible additional costs associated with premium features or technical support.

- Ease of Use: The usability is crucial to ensure a smooth and efficient transition. Opt for solutions that offer a user-friendly interface y adequate training.

- Support and UpgradesMake sure that the software offers technical support and regular and regular updates to keep up with regulations and emerging technologies.

Frequent asked questions

In Spain, the valid formats for electronic invoicing electronic invoicing include:

- InvoiceE: This format is mandatory for invoices issued to public sector entities. It is the standard established by Spanish regulations for transactions with public administrations.

- UBL (Universal Business Language): It is an international standard format used for commercial transactions between companies. UBL is flexible and widely accepted in international trade.

- EDIFACT (Electronic Data Interchange for Administration, Commerce and Transport)EDIFACT is another international standard used in sectors that require a high degree of standardization in the exchange of electronic data.

It is essential to make sure that the format chosen complies with the legal legal norms and is compatible with the invoice recipient’s systems. The correct choice of format ensures efficient integration and avoids problems in the processing of electronic invoices.

In Spain, the valid formats for electronic invoicing electronic invoicing include:

- InvoiceE: This format is mandatory for invoices issued to public sector entities. It is the standard established by Spanish regulations for transactions with public administrations.

- UBL (Universal Business Language): It is an international standard format used for commercial transactions between companies. UBL is flexible and widely accepted in international trade.

- EDIFACT (Electronic Data Interchange for Administration, Commerce and Transport)EDIFACT is another international standard used in sectors that require a high degree of standardization in the exchange of electronic data.

It is essential to make sure that the format chosen complies with the legal legal norms and is compatible with the invoice recipient’s systems. The correct choice of format ensures efficient integration and avoids problems in the processing of electronic invoices.

The choice of ERP can have a significant impact on business growth. A properly selected and well-implemented ERP can improve operational efficiency, increase productivity, facilitate data-driven decision making and promote cross-departmental collaboration. All this contributes to a faster and more sustainable growth of the company. On the other hand, an incorrect ERP choice or poor implementation can result in additional costs, operational disruptions and obstacles to growth. Therefore, it is important to conduct a thorough assessment of the company’s needs and select an ERP that is properly aligned with its objectives and growth strategies.

Share:

Related Articles

What is a marketplace? Find out how to get the most out of it

What is a marketplace? Find out how to get the most out of it In today’s digital world, marketplaces have

Business to consumer (B2C): how it works and how it differs from B2B

Business to consumer (B2C): how it works and how it differs from B2B In today’s world, e-commerce and direct business-to-consumer

Alibaba revolutionises B2B commerce with ‘Accio’ – the AI-powered search engine for SMEs

Alibaba revolutionises B2B commerce with ‘Accio’ – the AI-powered search engine for SMEs Share: Tabla de contenidos What is Accio

Examples of market segmentation: How to apply it in different sectors?

Examples of market segmentation: How to apply it in different sectors? In today’s competitive business landscape, market segmentation is more

Omni-channel strategy: How to integrate all channels to improve customer experience

Omni-channel strategy: How to integrate all channels to improve customer experience In a world where consumers use multiple channels to

What are open APIs and their role in SaaS solutions?

What are open APIs and their role in SaaS solutions? Open APIs have transformed the way businesses use software, especially

Analysis of B2B marketplaces: Are they an opportunity or a threat?

Analysis of B2B marketplaces: Are they an opportunity or a threat? B2B marketplaces are transforming the way companies buy and

How to use chatbots in B2B ecommerce to improve conversions

How to use chatbots in B2B ecommerce to improve conversions In the world of ecommerce B2B (Business to Business)shopper expectations

ERP and sustainability: How a system can reduce environmental impact

ERP and sustainability: How a system can reduce environmental impact Sustainability has become a crucial priority in today’s business landscape.

Automate orders with Stoam SaaS b2b ecommerce